International Road Transport

LEARN ABOUT OUR FLEET

MONITOR YOUR CARGO

TRANSPORT SERVICES WITH LOADING LIFTS

MONITOR YOUR CARGO

In order to ensure fast, timely and safe international transport for regular and occasional shipments throughout Europe, we have created CONTROL TOWER, which is a monitoring department, responsible for the flow of information between the driver and the customer on a 24/7 basis, including weekends and holidays. Each customer receives real-time statuses about the execution of the transport of his goods at every stage. Thanks to Control Tower, we can also react immediately in situations beyond our control, such as increased traffic, accidents or vehicle breakdown.

Find out more about → TRANSPORT MONITORING

Sprawdź naszą ofertę

The company’s history

EURO24’s beginnings date back to 2007, when with a fleet of two delivery vans, we carried out transports for a Swiss logistics company. Two years later, we launched our own logistics business, securing our first contracts to service manufacturers in the automotive industry.

In order to enhance the quality of EURO24’s services, we opened our first foreign branch in the United Kingdom in 2011. In the following years, branches were established in Germany and Spain. EURO24’s rapid development was recognized by industry experts and honored with the prestigious title of Business Gazelle.

Read MoreWhy Us?

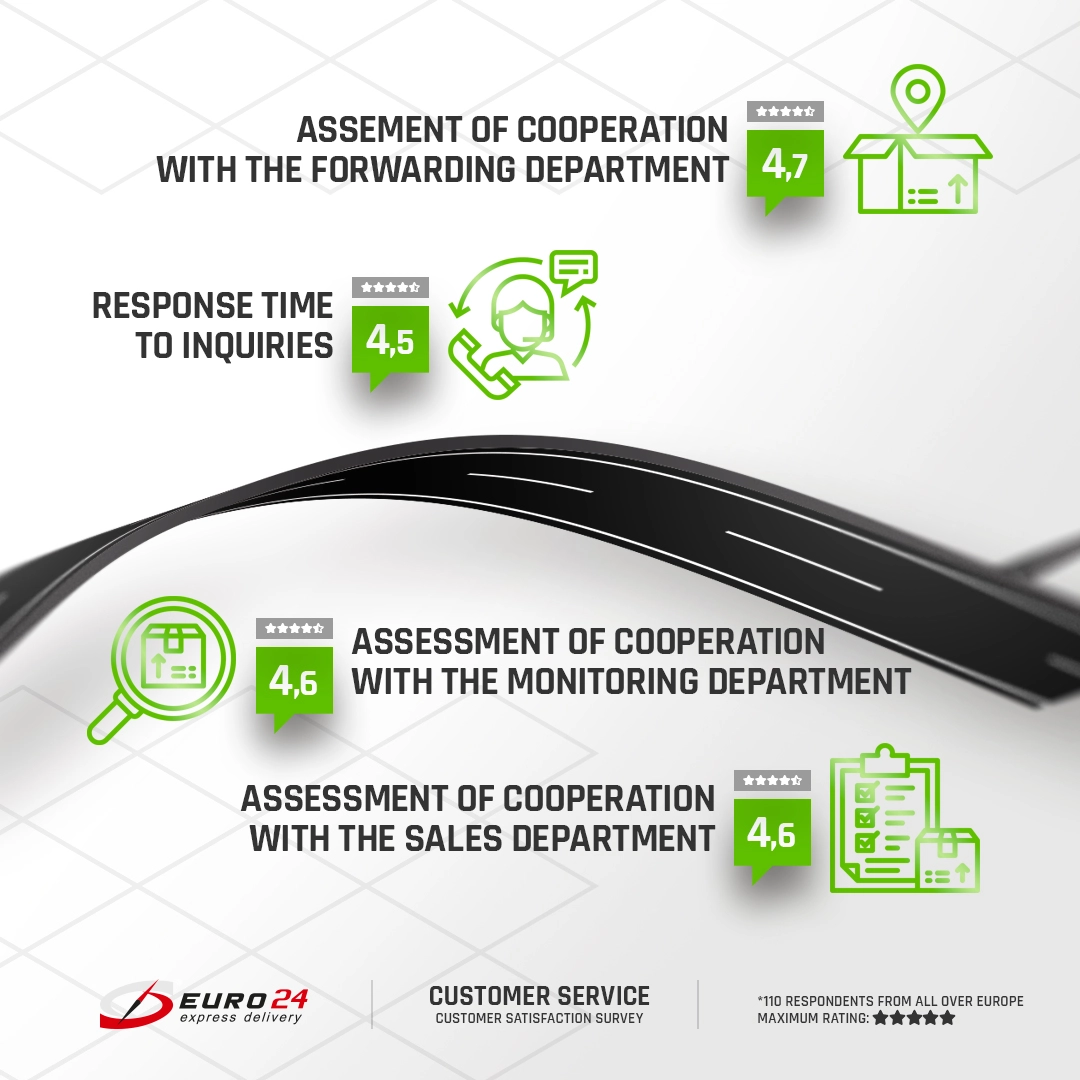

REFERENCES

Join us!

We are looking for full-time employees!

100 %

POSITIVE OPINIONS*.

*based on the platform www.trans.eu

Check out the current

Job offersDo you have questions about transportation?

- Transport quote

- Transport monitoring

+48 17 859 20 01 rzeszow@euro24.co

Get a QuoteEuro24 Rzeszów HEADQUARTERS

ul. Żołnierzy 9-Dywizji Piechoty 8, 35-083 Rzeszów

EURO24 Wrocław

ul. Strzegomska 140A, 54-429 Wrocław

EURO24 Katowice

ul. 73 Pułku Piechoty 7A, 40-496 Katowice

EURO24 Warszawa

al. Jana Pawła II 22, 00-133 Warszawa

EURO24 Deutschland GmbH

Rotenburger Str. 30, 30659 Hannover, Niemcy

EURO24 EXPRESS SPAIN

Letxumborro Hiribidea, 102, 1º – OFICINA 2, 20305 Irun, Gipuzkoa, Hiszpania

EURO24 Express Delivery LTD

9 Station Parade Uxbridge Road Ealing Common, W5 3LD London